SOL Price Prediction: Analyzing the Path to $300 Amid Bullish Momentum

#SOL

- Technical indicators show SOL trading above key moving averages with positive momentum signals

- Strong institutional interest evidenced by $7B+ futures open interest and whale accumulation

- Regulatory developments including potential ETF approval could provide additional upside catalyst

SOL Price Prediction

Technical Analysis: SOL Shows Bullish Momentum Above Key Moving Average

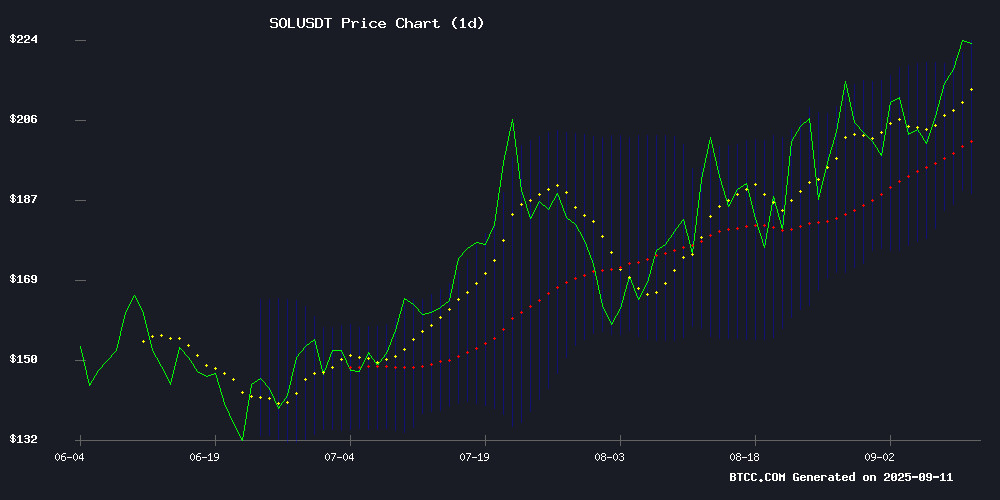

SOL is currently trading at $222.34, significantly above its 20-day moving average of $206.33, indicating strong bullish momentum. The MACD indicator shows improving conditions with the histogram turning positive at 1.32, suggesting potential upward momentum continuation. The price is testing the upper Bollinger Band at $223.82, which could act as immediate resistance. According to BTCC financial analyst Mia, 'The technical setup suggests SOL has room for further gains if it can maintain above the $200 support level, with the next major resistance around the $260 region.'

Market Sentiment: Bullish Fundamentals Support SOL's Rally

Market sentiment for SOL remains overwhelmingly positive as evidenced by multiple bullish catalysts. solana perpetual futures open interest surpassing $7 billion indicates strong institutional interest, while the $200 support level holding firm provides technical confirmation. The SEC's review of a spot Solana ETF and significant whale accumulation suggest growing institutional adoption. BTCC financial analyst Mia notes, 'The combination of technical strength, institutional interest, and positive regulatory developments creates a favorable environment for SOL's continued appreciation toward higher targets.'

Factors Influencing SOL's Price

Solana Perpetual Futures Open Interest Surpasses $7 Billion Amid Price Rally

Solana's perpetual futures open interest has breached the $7 billion mark, signaling heightened speculative activity as SOL's price continues to outperform broader markets. Glassnode data reveals the metric—tracking both long and short contracts across derivatives platforms—has surged alongside SOL's push above $200.

The rally reflects growing market participation, though analysts caution that excessive leverage buildup could increase liquidation risks. Historically, such open interest spikes coincide with bullish momentum as traders capitalize on volatility.

Solana Bulls Dominate as $200 Support Holds for Potential Run to $260

Solana has broken out of a symmetrical triangle pattern, with $200 emerging as a critical support level. The altcoin's bullish momentum suggests a potential rally toward $260, with further upside to $300 if buying pressure persists. Higher lows and strong volume confirm the breakout's validity, though traders remain wary of a retest of $200 that could trigger renewed selling.

Futures activity shows signs of overheating, with the Futures Volume Bubble Map indicating excessive leverage. Short positions have suffered $6.3 million in liquidations, reinforcing bullish dominance. However, concentrated leverage raises the risk of liquidation cascades if the market corrects abruptly.

Solana Price Prediction: SOL Hits 7-Month High – Bulls Eye $1,000 Next

Solana (SOL) has surged past $220 for the first time since February, marking a seven-month high as bullish momentum builds. The rally appears driven by strategic positioning rather than retail inflows, with new user onboarding slowing to April levels. Macro tailwinds, including anticipated U.S. interest rate cuts, are fueling investor optimism.

On-chain data reveals a concerning gap: new address creation has fallen to a five-month low, leaving SOL vulnerable to profit-taking. Yet technical indicators suggest room for growth. The RSI at 62 remains below the overbought threshold, while a rising wedge pattern hints at an imminent breakout. Market participants now speculate whether $1,000 could become the next milestone.

SEC Reviews Franklin Spot Solana ETF Amid Whale Accumulation – $250 Next?

Solana's price prediction turns increasingly bullish as it breaks through an 8-month resistance at $220, fueling hopes of a sustained rally. The SEC's review of Franklin's Spot solana ETF, now pushed to a November 14, 2025 deadline, has intensified market optimism. Large-scale accumulation by whales and Digital Asset Treasuries (DATs) suggests growing institutional interest.

Grayscale, VanEck, and 21Shares have also submitted Solana ETF proposals, with most facing similar delays. Polymarket odds now show 99% confidence in Solana ETF approval by year-end 2025. Fresh Solana wallets linked to Coinbase Prime have received $48.2 million worth of SOL, signaling strategic positioning by major players.

Black Mirror-Inspired $MIRROR Token Launches on Multiple Blockchains and Exchanges

The dystopian Netflix series Black Mirror has spawned a new cryptocurrency, with the $MIRROR token launching on Avalanche, Solana, and Base blockchains. Backed by heavyweights like Republic crypto and Animoca Brands, the token is now tradable on Gate.io, Kraken, MEXC, and Binance Alpha.

Base's Aerodrome Finance and Solana's Meteora DEXs enable direct on-chain trading. The token surged 129% despite skepticism from Reddit communities about its authenticity. Black Mirror's cult following and exploration of technology's dark side provide a unique narrative for this IP-based crypto experiment.

With listings across major centralized and decentralized exchanges, $MIRROR represents one of the first major attempts to tokenize a mainstream entertainment franchise. The project aims to onboard Black Mirror's global fanbase into web3, though long-term viability remains uncertain in volatile crypto markets.

Solana and Hyperliquid Rally Sparks Interest in Crypto Presales

Solana and Hyperliquid have emerged as standout performers in a mixed crypto market, with institutional adoption driving their recent gains. Solana rose 5.7% this week to $220—its highest level since January—after Galaxy Digital tokenized its Nasdaq-listed stock on the blockchain. Hyperliquid, meanwhile, hit a record high with a 22% weekly surge.

The rally has shifted attention to presale opportunities for new tokens that could mirror these gains. Investors are scouting early-stage projects before exchange listings, betting on asymmetric returns. Market participants attribute Solana's momentum to TradFi integration, exemplified by SOL Strategies becoming the first Solana-native firm listed on Nasdaq.

Solana's Rally Faces Headwinds as Profit-Taking Risks Emerge

Solana's recent surge above $200 shows signs of vulnerability as on-chain metrics flash warnings. The cryptocurrency's Net Unrealized Profit/Loss (NUPL) ratio hit 0.321 on September 9, approaching levels that preceded an 8% correction in late August. Traders now sit on substantial paper gains—a classic setup for profit-taking.

Exchange data reveals weakening conviction behind the rally. While SOL climbed 10% to $217 between September 6-9, net outflows from exchanges plummeted 84% during the same period. This divergence between price action and capital flows suggests the rally lacks sustainable buying pressure.

Market veterans recognize this pattern—Solana's history of faltering above psychological resistance at $200 creates a self-fulfilling prophecy. The current technical setup mirrors previous bull traps, with overleveraged longs potentially facing liquidation if support breaks.

Solana and Based Eggman $GGs Emerge as Top Crypto Investment Opportunities

Altcoins are fueling innovation and adoption in the cryptocurrency market, with Solana maintaining its position as a high-performance blockchain. Meanwhile, new presale tokens like Based Eggman ($GGs) are capturing investor interest for their affordability and community-driven momentum.

Solana's scalability and robust market support make it a standout among established projects. The network continues to attract developers and users seeking fast, low-cost transactions.

Based Eggman's presale offers straightforward participation through its official website. Investors can acquire $GGs tokens by connecting a Web3 wallet and following a streamlined purchase process designed for security and accessibility.

Meme Coin Resurgence as Snorter Bot Token Presale Hits $3.8 Million

The meme coin market is heating up again, with total sector capitalization surpassing $80 billion. Tokens like Goatseus Maximus (GOAT) and AI Companions (AIC) surged nearly 23% in 24 hours, signaling renewed capital inflows.

This bullish sentiment is further evidenced by the $3.8 million presale of Snorter Bot Token (SNORT), a Solana-based Telegram trading bot specializing in meme coin breakout detection. Notably, the system maintains effectiveness during both market rallies and corrections.

Snorter's Fast Sniper feature outperforms competing Telegram bots by identifying opportunities before market explosions, giving retail investors early access to potential moon shots. The SNORT token currently sells at $0.1039, with prices set to increase within 48 hours as the presale advances.

CETO Exchange to List Solana-Based Memecoin Solfart (SOLF) After Successful Presale

CETOEX has become the first centralized exchange to confirm listing of Solfart (SOLF), a Solana-based memecoin that has sold over 1.5 billion tokens in its ongoing presale. The project has raised approximately $120,000 since launch six weeks ago, with daily sales recently exceeding 25 million tokens.

The exchange listing provides crucial liquidity assurance for presale participants, mitigating typical rug pull concerns associated with memecoin launches. Solfart gained viral traction through social media campaigns featuring purported developer 'Oprah Winfart,' demonstrating the continued appetite for speculative Solana ecosystem tokens.

Market observers note the listing announcement could accelerate presale momentum as traders position for potential exchange-driven liquidity events. The token's performance may serve as a bellwether for retail interest in Solana's memecoin sector following recent network congestion challenges.

Solana Reclaims $220 Amid Bullish Momentum, Eyes $250 Target

Solana (SOL) has surged past $220 for the first time since late January, marking a significant recovery from its April low of $105. The asset's steady climb reflects growing investor confidence, with gains of 0.8% in 24 hours, 5.7% weekly, and 20.9% monthly. Market capitalization now approaches $120 billion.

Total value locked (TVL) in Solana's ecosystem has reached a record $12 billion, further fueling bullish sentiment. Analysts diverge on short-term prospects: CoinCodex predicts a November peak near $246, while broader market Optimism suggests a potential breakthrough to $250 if macroeconomic conditions align.

Will SOL Price Hit 300?

Based on current technical indicators and market sentiment, SOL has a strong probability of reaching $300 in the medium term. The cryptocurrency is trading well above its 20-day moving average with positive MACD momentum, while fundamental factors including institutional adoption, ETF prospects, and strong community support provide additional tailwinds.

| Indicator | Current Value | Bullish Signal |

|---|---|---|

| Price vs 20-day MA | $222.34 vs $206.33 | Strong |

| MACD Histogram | +1.3208 | Positive |

| Bollinger Band Position | Testing Upper Band | Neutral/Bullish |

| Key Support Level | $200 | Holding Strong |

However, investors should monitor potential profit-taking risks as highlighted in recent market analysis.